Closing Costs in Florida

If you are a current Florida homeowner, then you probably learned about closing costs when you purchased your first house. Now, if you are looking to sell your home, you’ll be obligated to pay closing costs again. The closing costs for selling your house can range from 5%-10% of the sales price. These will be made up of things such as pro-rated property taxes and real estate commissions.

Below is an in-depth analysis of the closing costs you should expect to pay when selling your home.

Table of Contents

What Are Closing Costs?

Closing is the final stage of the home buying process and the consummation of the sale for both the buyer and the seller. By now, all the documents have been signed and the mortgage funds have been released.

As the seller of the property, your closing fees will mostly be to the real estate commission and the transferring of the deed to the buyer.

How much are closing costs in Florida?

When selling your home, you should expect to pay between 5% to 10% of the sales price of your home. A majority of this will come from the realtor fees you agreed to pay when listing your property, which can add on as much as 6%.

How to Calculate Closing Costs in Florida

To figure our an estimate of the amount you will pay, simply multiple the listing price of your home by the typical 5% to 10% average.

For Example: The current median listing price in Florida is $275,000. If you multiply this by the average costs of 5% to 10%, you will find the average closing cost range to be anywhere between $13,750 and $27,500.

In order to sell a house owned by the dependent, the court myst be notified and grand you permission. After permission has been given you can decide whether to hold an auction or sell it on the open market. If you choose to sell it on the market, you can list it with a realtor or sell it to a local investor, such as us.

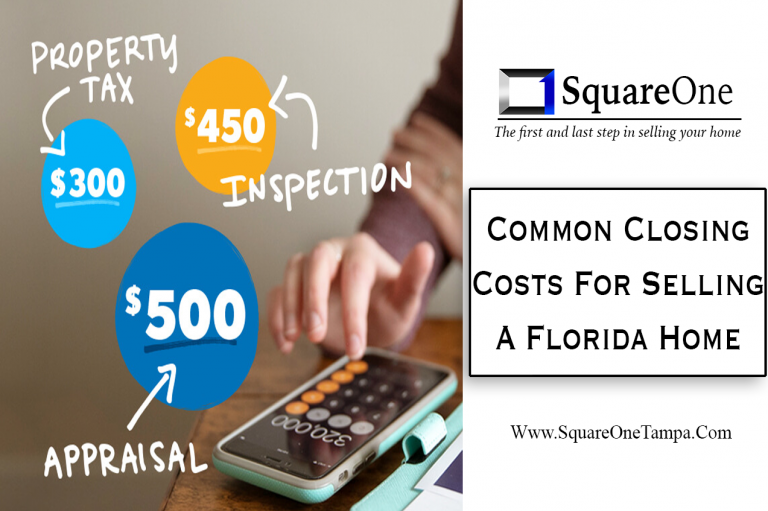

Common Florida Selling Costs

Here is a breakdown of all the costs that may be associated with selling your home.

- Real Estate Commission (5-6% of sales price) – If you intend to list your property on the market using the MLS, Zillow, or Redfin you will likely require the assistance of a real estate agent. The amount can differ between agents, but it is typically 5-6% to the selling agent, which is then split with the buyers agent.

- Prorated Property Taxes – Property taxes in Florida are paid in arrears (money that is owed and should have been paid earlier). You will owe property taxes for the

- Settlement Fee ($300-$600) – In the state of Florida an attorney is not required to be present at closing. However, you still need to pay a settlement fee to the title company or escrow company on the date of closing.

- Outstanding amounts owed on property – You will be responsible for any unsettled payments on your home such as HOA fees and utility bills. These costs will be prorated to the date of closing.

- Title Search ($100-$200) – A title search looks into the history of the home to ensure the owners and any liens on the property.

- Municipal Lien Search ($100-$200) – This search looks into any unrecorded property issues that are typically not shown in a title search. This will show code violations, water/sewer balances, or any open/expired permits.

- HOA Estoppel (if applicable) – This will be a letter from the homeowners association which will state how much you owe them. The swill include monthly dues, fees/fines, or any special assessments. The HOA can potentially put a lien on your home for unpaid dues or violations. The title company must confirm you are in good standing with the HOA before you can receive a clear title on the home.

- Title Insurance (rate determined by purchase price) – Commonly paid by the seller, however this is negotiable. The title insurance protects the buyer from issues that arise with the title such as liens that were not discovered in the search.

Reducing Closing Costs in Florida (For Sellers).

The easiest way to reduce your closing costs is to reduce the real estate agent commission. As stated before the real estate agent typically takes anywhere from 5-6% of the sale price, which is all covered by the seller.

Again:

$300,000 (Selling Price) x 6% (Typical Commission) = $18,000 Paid in Commission

Selling with a realtor may seem like the only option to most people, however there are other ways this can be done. There are many websites where you can list your home for sale by owner, or the traditional “Home For Sale” sign on your front lawn. These are good ways to save costs, however it may be hard to find buyers.

Here at Square One Tampa we give you the opportunity to sell your home completely free. If you are looking for the top value of your home, assuming it is in perfect condition than we do not recommend this route. However, if you are looking for a quick turnover, low cost way to sell your property we recommend you fill out our survey to the right to receive our no obligation offer.

Key Takeaways For Home Sellers in Florida

It is very important to understand the costs associated with selling your home before you get caught up in the process and the fees start adding up. Once you enter a contract with a realtor, typically, you are responsible to give them commission regardless of how you sell your property.

To help align your selling costs we recommend that you consult with a licensed agent who can help you set the best approach to get the top value for your home.

If saving money is your top priority we recommend you reach out to us to discuss your options.

Get Your Cash Offer Today

Contact Us Today To Get An Instant Cash Offer On Your Home